Biznesradar bez reklam? Sprawdź BR Plus

Branża Gry

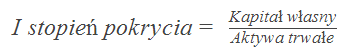

Wskaźniki płynności: I stopień pokrycia

Zobacz opis wskaźnika

- I stopień pokrycia

Wskaźnik jest stosunkiem kapitału własnego przedsiębiorstwa do aktywów trwałych.

Wartość wskaźnika powinna być większa od 0.6, dzięki czemu spółka zapewnia spłatę należności, nawet w razie jej bankructwa.

| Profil | Raport | I stopień pokrycia | r/r | k/k |

|---|---|---|---|---|

| MAN (MANYDEV) | 2024/Q4 | |||

| DGS (DEMGAMES) | 2025/Q1 | |||

| IMG (IMMGAMES) | 2025/Q1 | |||

| END (ENEIDA) | 2025/Q1 | |||

| MUN (MUNAR) | 2025/Q1 | |||

| MLT (MOONLIT) | 2025/Q1 | -5,58 | -100,49% | -869,66% |

| PBT (PBGAMES) | 2025/Q1 | -5,26 | -1 127,71% | -6,90% |

| OXY (OXYGEN) | 2024/Q1 | -1,97 | -1 121,21% | -9,41% |

| IPW (IMAGEPWR) | 2025/Q1 | -1,60 | -139,60% | -25,46% |

| MPS (MEGAPIXEL) | 2025/Q1 | -0,58 | +65,13% | -26,76% |

| ALG (AIGAMES) | 2024/Q4 | -0,50 | +64,37% | -2,39% |

| THD (THEDUST) | 2025/Q1 | -0,05 | +92,73% | -4 191,67% |

| FOX (SPACEFOX) | 2025/Q1 | 0,03 | 0,00% | |

| ICG (ICECODE) | 2025/Q1 | 0,10 | -83,05% | -38,47% |

| DEG (DETGAMES) | 2025/Q1 | 0,37 | -35,05% | -6,56% |

| CHP (CHERRY) | 2025/Q1 | 0,38 | -57,76% | -25,74% |

| DDI (DDISTANCE) | 2025/Q1 | 0,47 | +8,06% | +17,48% |

| 7LV (7LEVELS) | 2025/Q1 | 0,60 | +105,81% | +116,08% |

| K2P (KOOL2PLAY) | 2025/Q1 | 0,62 | -68,81% | +0,76% |

| TGS (TRUEGS) | 2025/Q1 | 0,63 | -22,03% | -7,57% |

| IMR (INTM) | 2025/Q1 | 0,71 | -30,81% | -0,91% |

| UFG (UFGAMES) | 2025/Q1 | 0,72 | -43,98% | -22,67% |

| RST (ROAD) | 2025/Q1 | 0,73 | +6,54% | +20,52% |

| CIG (CIGAMES) | 2024/Q4 | 0,73 | -13,02% | -8,46% |

| VVD (VIVID) | 2024/Q4 | 0,75 | +65,16% | +114,90% |

| TBL (TBULL) | 2024/Q4 | 0,79 | -30,03% | -17,36% |

| PIX (PIXELCROW) | 2024/Q3 | 0,85 | -5,95% | -1,82% |

| OVI (OVIDWORKS) | 2025/Q1 | 0,85 | +319,89% | +1,54% |

| PRH (POLHOLROZ) | 2025/Q1 | 0,86 | -5,10% | |

| QUB (QUBICGMS) | 2025/Q1 | 0,86 | -8,79% | +12,82% |

| BLO (BLOOBER) | 2024/Q4 | 0,88 | -12,75% | +5,96% |

| GIF (GAMFACTOR) | 2024/Q4 | 0,92 | -84,00% | -90,83% |

| OML (ONEMORE) | 2025/Q1 | 0,94 | -54,94% | -23,52% |

| DPG (DARKPOINT) | 2025/Q1 | 0,96 | +5,15% | +1,70% |

| BTC (BTCSTUDIO) | 2024/Q1 | 0,97 | -1,48% | -0,31% |

| SHY (SHEEPYARD) | 2024/Q1 | 0,98 | +1,24% | +0,60% |

| MOV (MOVIEGAMES) | 2024/Q4 | 0,99 | +20,62% | -4,75% |

| BBT (BOOMBIT) | 2024/Q4 | 1,00 | -6,04% | +7,21% |

| CRB (CARBONSTU) | 2025/Q1 | 1,02 | -3,40% | +6,32% |

| TCR (TECHROBOT) | 2025/Q1 | 1,04 | +42,70% | |

| PCF (PCFGROUP) | 2024/Q4 | 1,05 | -29,66% | -6,74% |

| VRF (VRFACTORY) | 2025/Q1 | 1,06 | +4,34% | -0,38% |

| BRP (BLACKROSE) | 2025/Q1 | 1,11 | +11,74% | +30,75% |

| FOR (FOREVEREN) | 2025/Q1 | 1,14 | -6,50% | -6,39% |

| 3RG (3RGAMES) | 2024/Q4 | 1,16 | +0,38% | -3,53% |

| NOB (NOOBZ) | 2025/Q1 | 1,25 | +20,60% | -67,37% |

| 11B (11BIT) | 2025/Q1 | 1,28 | +14,98% | -5,73% |

| GDC (GAMEDUST) | 2025/Q1 | 1,33 | +24,56% | +1,50% |

| TEN (TSGAMES) | 2025/Q1 | 1,34 | +47,69% | +13,90% |

| SIM (SIMFABRIC) | 2024/Q4 | 1,39 | +54,74% | +106,79% |

| WLI (WILDINT) | 2025/Q1 | 1,42 | -95,67% | -96,50% |

| SOK (SONKA) | 2025/Q1 | 1,55 | -94,45% | -34,02% |

| VAR (VARSAV) | 2025/Q1 | 1,63 | -27,09% | -7,96% |

| PGG (PROGUNSGR) | 2025/Q1 | 1,77 | -99,50% | |

| CDR (CDPROJEKT) | 2024/Q4 | 1,78 | +7,38% | +3,01% |

| IVO (INCUVO) | 2025/Q1 | 1,85 | +12,12% | +4,69% |

| KBT (KLABATER) | 2025/Q1 | 1,98 | +48,67% | +17,24% |

| F51 (FARM51) | 2025/Q1 | 2,13 | -61,75% | +16,50% |

| PPG (PUNCHPUNK) | 2023/Q1 | 2,36 | -99,05% | -1,95% |

| LMG (LMGAMES) | 2025/Q1 | 2,77 | -98,67% | -78,33% |

| VFA (VRFABRIC) | 2025/Q1 | 3,12 | +20,85% | +49,78% |

| RND (RENDER) | 2025/Q1 | 3,25 | -1,25% | +11,70% |

| PLW (PLAYWAY) | 2024/Q4 | 3,45 | +16,36% | +10,18% |

| CRJ (CREEPYJAR) | 2024/Q4 | 3,59 | -34,54% | +0,25% |

| GOP (GAMEOPS) | 2024/Q4 | 3,86 | +27,70% | -23,53% |

| SMT (SIMTERACT) | 2025/Q1 | 4,18 | -7,13% | +5,64% |

| HUG (HUUUGE) | 2024/Q4 | 6,69 | +12,54% | +32,50% |

| GMV (GAMIVO) | 2025/Q1 | 7,16 | +34,44% | +30,36% |

| ART (ARTIFEX) | 2025/Q1 | 7,47 | +34,71% | +8,24% |

| JJB (JUJUBEE) | 2025/Q1 | 9,12 | +148,95% | +19,53% |

| PLT (PLOTTWIST) | 2025/Q1 | 9,82 | -66,25% | -5,69% |

| NRS (NEURONE) | 2025/Q1 | 9,85 | ||

| RSG (RSGAMES) | 2025/Q1 | 10,83 | -70,65% | +67,92% |

| CFG | 2025/Q1 | 10,83 | -70,91% | -93,76% |

| STA (STARWARD) | 2025/Q1 | 14,14 | +27,99% | -3,18% |

| CWA (CONSOLEW) | 2025/Q1 | 16,82 | +25,66% | +10,96% |

| BCS (BIGCHEESE) | 2024/Q4 | 16,89 | +24,72% | +5,30% |

| LHD (LICHTHUND) | 2025/Q1 | 17,46 | +55,84% | -10,22% |

| FRW (FROZENWAY) | 2025/Q1 | 21,66 | -8,58% | +21,12% |

| CLA (CONSOLE) | 2025/Q1 | 21,67 | -3,30% | +3,44% |

| ARG (ARTGAMES) | 2025/Q1 | 25,00 | -59,87% | +9,49% |

| ULG (ULTGAMES) | 2025/Q1 | 25,27 | +325,39% | +165,55% |

| DUA (DUALITY) | 2025/Q1 | 27,25 | +152,24% | +604,01% |

| MMS (MADMIND) | 2025/Q1 | 27,86 | +24,18% | -5,47% |

| DRG (DRAGEUS) | 2025/Q1 | 28,17 | +79,24% | +0,50% |

| DGE (DRAGOENT) | 2024/Q4 | 38,35 | +20,61% | -21,48% |

| GDS (GDEVS) | 2025/Q1 | 40,30 | -83,01% | -0,58% |

| ATJ (ATOMJELLY) | 2025/Q1 | 47,55 | -27,28% | -3,15% |

| PDG (PYRAMID) | 2025/Q1 | 85,74 | +345,47% | +44,30% |

| IWS (IRONWOLF) | 2025/Q1 | 88,64 | -59,58% | -13,72% |

| GHT (GAMEHUNT) | 2025/Q1 | 90,80 | -78,96% | -7,70% |

| P2C (P2CHILL) | 2025/Q1 | 96,16 | -0,17% | +0,60% |

| BKD (BKDGAMES) | 2025/Q1 | 114,75 | -27,44% | -3,80% |

| LTM (LTGAMES) | 2025/Q1 | 224,67 | +2 666,32% | +8 150,71% |

| FRM (FREEMIND) | 2025/Q1 | 455,83 | -36,72% | -62,82% |

| MGS (MADNETIC) | 2025/Q1 | 1 295,50 | +7,87% | +5,54% |

| PSH (POLYSLASH) | 2023/Q3 | 1 659,00 | +156,35% | +51,28% |

| ECC (ECCGAMES) | 2025/Q1 | 2 716,50 | +719,24% | +46,97% |

| FLG (FALCON) | 2024/Q1 | 4 926,67 | -0,14% | +0,13% |

Wskaźniki prezentują jedynie użyteczne informacje dotyczące kondycji finansowej spółek i nie są rekomendacją w rozumieniu przepisów Rozporządzenia Ministra Finansów z dnia 19 października 2005 r. w sprawie informacji stanowiących rekomendacje dotyczące instrumentów finansowych lub ich emitentów (Dz. U. z 2005 r. Nr 206, poz. 1715).

Biznesradar bez reklam? Sprawdź BR Plus